Abstract

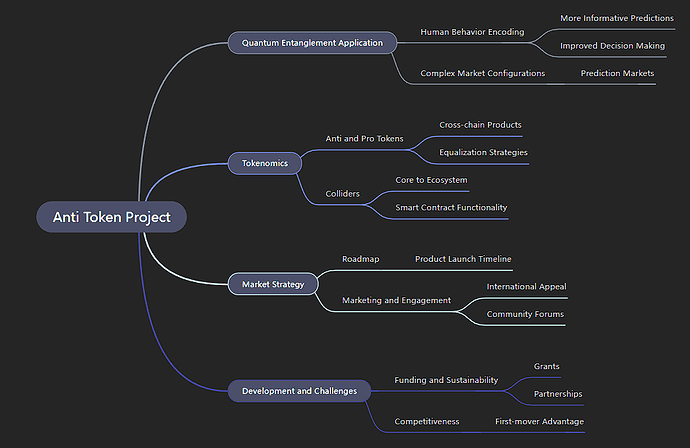

The Spaces focused on introducing and discussing the concepts surrounding the Anti Token project, specifically leveraging quantum entanglement in economics for creating complex prediction markets. The hosts and participants examined various topics such as the project’s roadmap, market strategy, tokenomics involving Anti and Pro tokens, and global engagement plans. SSH, the primary speaker, explained the potential applications in prediction markets and the underlying technology, along with addressing concerns about token pricing and possible depegging issues. The discussions also covered future collaboration via cross-chain integration and upcoming developments aiming to enhance market positioning and outreach.

Introduction

The discussion features a conversation about the innovative Anti token project, focusing on its elements of quantum entanglement and decentralized finance applications. Speakers include a developer referred to as SSH, who provides insight into the project, and several participants who ask questions throughout the session.

Key Topics Discussed

Quantum Entanglement in the Web3 Space

SSH explains the concept of quantum entanglement as a metaphor for complex decision-making models, allowing for nuanced outcomes rather than binary ones. The goal is to create prediction markets that can handle more complex queries and offer users a spectrum of possible results with associated probabilities, rather than simple yes/no answers.

Tokenomics of Anti and Pro Tokens

The project features two main tokens, Anti and Pro, which are used in tandem to interact with “Collider” contracts. These contracts are responsible for various outputs and are analogous to smart contracts with quantum-like properties. The economic model aims to balance the tokens’ values by ensuring that both are needed for interactions within the ecosystem. SSH outlines mechanisms to keep the prices of Anti and Pro tokens aligned closely, utilizing prediction and derivative markets across different blockchain platforms.

Application Development and Roadmap

SSH discusses the roadmap, mentioning the development of cross-chain derivative products and prediction markets expected within 2-6 months. The aim is to launch a more sophisticated prediction market akin to Polymarket, leveraging the quantum-like capabilities of the Anti and Pro tokens. Collaborations with various foundation teams for funding and development support are also in progress.

Challenges and Opportunities

The team anticipates potential challenges with market and token price stability, particularly scenarios where only one token might be listed on exchanges. There are strategies in place to manage these challenges, including liquidity pool interventions and incentivizing market-driven price equalization.

Community and Marketing Strategy

The project has significant traction in Asian markets but is actively seeking to expand its reach in Western markets. Upcoming activities include global AMAs and partnerships with influencers across various crypto communities. SSH stresses the importance of balancing the meme and utility aspects of the project to attract a diverse audience.

Participant Interactions

- Jane and Jin: Participants expressed curiosity about token price management in different exchange scenarios and received detailed responses about the project’s economic alignment strategies.

- Midnight: Inquired about distinctions between meme and utility aspects, emphasizing the need for market narratives to engage broader investment communities.

- Tudushan: Sought clarity on the economic implications of token transitions in various project phases.

- Other Participants: Various questions addressed potential challenges in token peg stability and mechanisms ensuring seamless interaction between global and local markets.

Conclusion

SSH provides assurances about the project’s progress and upcoming developments, such as the launch of a rebranded web page and additional forum interactions. The discussion concludes with a commitment to ongoing transparency and community engagement as the project evolves.

The session highlights the project’s innovative approach to integrating decentralized finance with advanced predictive modeling, backed by a supportive community eager to see its successful implementation.

good job. ![]() read … !!!

read … !!!

Chinese community rolls different ![]()

中文版如下:

摘要

本次会议专注于介绍和讨论“Anti代币”项目相关概念,特别是利用量子纠缠原理在经济领域创建复杂预测市场的应用。主持人和参与者探讨了项目路线图、市场策略、Anti和Pro代币的代币经济学、以及全球推广计划等多个主题。主要发言人SSH详细说明了预测市场的潜在应用及其底层技术,并回答了关于代币定价和可能脱钩问题的担忧。讨论还涉及跨链集成的未来合作及旨在增强市场定位和拓展影响力的开发计划。

引言

本次讨论围绕具有创新性的“Anti代币”项目展开,重点介绍其量子纠缠和去中心化金融的应用。主要发言人包括开发者SSH,他为项目提供了深入见解,同时多位参与者在会议中提出了问题并展开讨论。

主要讨论内容

Web3领域中的量子纠缠

SSH将量子纠缠的概念作为复杂决策模型的比喻,允许生成更为细致的结果而非简单的二元选择。目标是创建能够处理复杂问题的预测市场,为用户提供一系列可能结果及其对应的概率,而非单纯的“是/否”答案。

Anti和Pro代币的代币经济学

项目的核心是Anti和Pro两种代币,它们配合“对撞机”(Collider)合约使用。这些合约类似具有量子特性的智能合约,负责生成多种输出。经济模型旨在通过确保两种代币在生态系统中的必要性,平衡其价值。SSH介绍了一些机制,通过预测市场和衍生市场来保持两种代币价格的紧密对齐,适用于不同区块链平台。

应用开发与路线图

SSH提到路线图,包括计划在2-6个月内开发跨链衍生产品和预测市场。目标是推出类似Polymarket的更复杂预测市场,同时利用Anti和Pro代币的类量子功能。团队正在与多个基金会合作以争取资金和开发支持。

挑战与机遇

团队预计市场和代币价格稳定性可能面临挑战,尤其是在只有一种代币上市交易的情况下。针对这些问题,项目设计了包括流动性池干预和市场驱动价格均衡激励等策略。

社区与市场推广策略

目前项目在亚洲市场已有显著影响力,团队正积极寻求扩展至西方市场的机会。即将开展的活动包括全球AMA和与加密社区内各种意见领袖的合作。SSH强调需要在项目的“模因文化”(meme)和实用性之间找到平衡,以吸引多样化的受众。

参与者互动

- Jane 和 Jin:提出关于在不同交易所场景下如何管理代币价格的问题,SSH详细解释了项目的经济对齐策略。

- Midnight:询问了项目中“梗文化”和实用性之间的区别,强调需要通过市场叙事吸引更广泛的投资群体。

- Tudushan:寻求对不同项目阶段中代币转换经济影响的进一步理解。

- 其他参与者:提出了一些关于代币挂钩稳定性和全球与本地市场交互机制的潜在挑战问题。

结论

SSH对项目进展和即将到来的开发计划表达了信心,例如即将上线的全新品牌网页和更多论坛互动。会议以承诺持续透明和社区参与为结束语,期待项目的进一步发展。

本次会议展示了该项目在将去中心化金融与先进预测模型相结合方面的创新方法,同时得到了支持性社区的热烈响应,期待其成功实施。